Wheels within wheels …

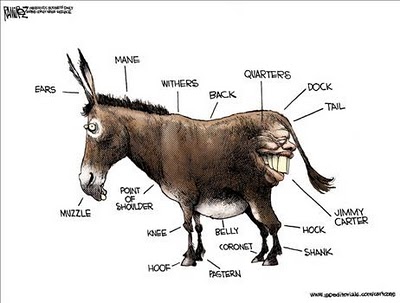

The problem is the solution is the problem ... The economic model is faulty. Every choice is a difficult choice. Any kind of make-do effort will need immense application. | Cartoonist David Fitzsimmons, in The Arizona Star on 26/1/2009 12:00:00 AM; source & courtesy - caglecartoons.com | Click for larger source image.

Hide the Big Truth

Joseph Stiglitz.

Ex-chief economist of the World Bank, (96-99), resigned one month before his term expired. He published his resignation in the New Republic, portraying himself as a dissident, the champion of the Third World, anti-World Bank crusader, etc, etc. Stiglitz brazenly shows himself as a giant, against whom Lawrence Summers and Wolfenson conspired, as he chose “not to circumscribe my thoughts. So I chose to resign.”

How brave!

Stiglitz’ targets were (as he chose to describe) “third-rank students from first-rate universities.” Stiglitz knows the media too – well. His article in New Republic, his interview in Financial Express were all excellent ploys to build his reputation. And after all this media management, he did get a Nobel Prize.

And after gaining our confidence, he slips in the Big Lie!

Pushing the case for the Big Stimulus, being paid for by the American taxpayer (Godzilla-Sized lie) is something that Big Business in America desperately needs (small lies) to survive. The Chinese and Japanese are footing this bill (The Big Truth) – as also are Russians, Indians and ASEAN countries (A Medium-To-Big Truth).

To his credit

What Stiglitz has done, is tell us a lot of little things. Little known and little truths, about little things on the The Great Recession.

The real failings in the Obama recovery programme, however, lie … in its efforts to revive financial markets. America’s failures provide important lessons to countries around the world, which are or will be facing increasing problems with their banks:

• Delaying bank restructuring is costly, in terms of both the eventual bailout costs and the damage to the overall economy in the interim.

• Governments do not like to admit the full costs of the problem, so they give the banking system just enough to survive, but not enough to return it to health.

• Confidence is important, but it must rest on sound fundamentals. Policies must not be based on the fiction that good loans were made …

• Bankers can be expected to act in their self-interest on the basis of incentives. Perverse incentives fueled excessive risk-taking …

• Socialising losses while privatising gains is more worrisome than the consequences of nationalising banks … in the recent cash infusions, it is estimated that Americans are getting $0.25, or less, for every dollar.

• Don’t confuse saving bankers and shareholders with saving banks. America could have saved its banks, but let the shareholders go, for far less than it has spent.

• Trickle-down economics almost never works. Throwing money at banks hasn’t helped homeowners: foreclosures continue to increase.

• Lack of transparency got the US financial system into this trouble. Lack of transparency will not get it out.

• Better to be forward looking than backward looking, focusing on reducing the risk of new loans and ensuring that funds create new lending capacity, than backward looking. Bygone are bygones. As a point of reference, $700 billion provided to a new bank, leveraged 10 to 1, could have financed $7 trillion of new loans.

The era of believing that something can be created out of nothing should be over … More money will be needed, but Americans are in no mood to provide it — certainly not on the terms that have been seen so far. The well of money may be running dry, and so, too, may be America’s legendary optimism and hope. (via How to fail to recover).

We have been told the truth …

The two people who have told us the ‘truth’ are Ben Bernanke and Lawrence Summers.

Ben Bernanke announced to the world that he would print money, before the National Economists Club, Washington, D.C. November 21, 2002. On March 23, 2006, Ben Bernanke further decided not to tell the world how much money he was printing.

Bindaas. No hesitation. They let it all hang out.

And then the coup de grace

Ben Bernanke went right ahead exploded a propaganda bomb. He decided to inform the world that the cause of the global financial crisis was the Asian ‘savings glut.’

And Lawrence Summers described this to the RBI correctly as “balance of financial terror.” In a speech on March 23, 2004, at the Institute for International Economics, Lawrence Summers described the US strategy as a “balance of financial terror”. Again on March 24, 2006, at the Reserve Bank of India lecture, he repeated his message.

These two threw down the gauntlet, and challenged central bankers of the world, “We are doing this! Stop us if you can! Let us see what you can do about this.” And the central bankers decided to do nothing.

Except whine, beg, plead and cry.

When economists talk ...

Readers beware

And that is problem. The economists that the media lionizes, apart from Joseph Stiglitz, like Paul Krugman (Princeton) and Dani Rodrik (Harvard) and Jeffrey Sachs are all cut from the same cloth.

Same difference.

Related articles

- Austerity is ‘suicide pact’ for major economies: Stiglitz (business.financialpost.com)

- Robert Teitelman: Stiglitz Explains the Great Depression (huffingtonpost.com)

- STIGLITZ: America’s Recent College Grads Face A Bleak Future (businessinsider.com)

- Government stimulus measures too feeble: Stiglitz (theglobeandmail.com)

- WB to provide up to $5.5 bln to Pak for next 3 years (nation.com.pk)

- Stiglitz: We Were Already In Trouble In 2007 (huffingtonpost.com)

- Stiglitz: What Can Save the Euro? (3eintelligence.wordpress.com)

-

April 23, 2009 at 1:51 pmWhy Do Our Economic Models Keep Failing? - The Atlantic Business Channel « Quick Take - As It Happens

Exciting new series. From 1 Mar, 2010.

Exciting new series. From 1 Mar, 2010.