Archive

Of Mice and Men – 2015 Gold Outlook

USA, EU trade relationships with oil producers. The European hands-on, micro-management issue of trade balance seems to be delivering? Some may question, what it is delivering, though.

Of mice and men

While the US dollar is weakening, by design, Greece, Ireland, Portugal and Spain are being bankrupted by a deliberately overvalued Euro.

In such a scenario, China believes that it has a winning hand. Even though, the Chinese exports juggernaut has been slowed by a yuan, trading at 17 year-highs. March 2011 reports indicate

an unexpected $7.3 billion trade deficit, the biggest in seven years. The nation’s (China’s) exports rose at the slowest pace since November 2009.

The US is betting that a weak dollar will reignite economic growth – much like what happened after the Japanese Yen strengthened due to Plaza Accord (1985).

For Europe, the grand prix is to replace the dollar as the currency of international trade – especially oil trade. Euro as a international trade-currency-of-choice, will give the Euro region access to more than 1 trillion euros in zero-cost floating balances.

China is expecting the yuan to play a similar role. Such are plans made by mice and men.

Monsieur Murphy says

What can go wrong with these plans? Plenty.

The eternal enemy of currency manipulation – gold. As a million bureaucrats work on the mechanics of their plans,

Increasingly, everyone is a victim - except the powerful 0.5% elite that rules the world. Break their power. Buy gold. (Cartoonist - Ted Rall; courtesy - http://charlesgoyette.com). Click for larger image.

Sales of gold coins are on track for the best month in a year amid the worst commodities rout since 2008, a sign that bullion’s longest bull market in nine decades has further to run, if history is a guide.

The U.S. Mint sold 85,000 ounces of American Eagle coins since May 1 as the Standard & Poor’s GSCI Index of 24 raw materials fell 9.9 percent. The last time sales reached that level, bullion rose 21 percent in the next year. Gold will advance 17 percent to a record $1,750 an ounce by Dec. 31 and keep gaining in 2012, the median estimate in a Bloomberg survey of 31 analysts, traders and investors shows.

UBS AG, Switzerland’s biggest bank, had its second-best day this year for physical sales on May 9, according to a report the following day. The bank’s sales to India, the world’s top bullion consumer, are more than 10 percent higher than in 2010. (via Gold Coins Show Bull Market Unbowed in Commodities Decline – Bloomberg).

You take free advice …?

While George Soros talks of gold being the ultimate bubble, his companies are quietly buying gold.

Back in late January, as the world’s important people rubbed elbows in Davos, billionaire investor George Soros had some rather definitive thoughts to offer on gold, which he called “the ultimate asset bubble,” according to reports.

However, he neglected to mention that his hedge fund had been buying.

Another report points out that the liquidation (by people like Soros) of investments in public investment vehicles may be replaced by private investments.

In this game of musical chairs, when the music stops, everyone who does not own gold is out. (Cartoon by David Horsey; Courtesy - http://politicalhumor.about.com). Click for larger image.

The new filings from funds “may show that big names exited ETPs and this news may cause prices to slip in the very short term,” said Bayram Dincer, an analyst at LGT Capital Management in Pfaeffikon, Switzerland. Some funds switched to holding gold directly so they wouldn’t have to announce it publicly, he said.

Is gold a bubble?

A rather disbelieving journalist writes of the situation in the West

Gold is in a bubble. Anyone will tell you that. They’ve been saying it since gold was about, oh, $500 an ounce. But it’s a funny kind of a bubble. It’s the only one I’ve encountered where so few people seem to own the asset in question.

During the dot-com bubble, you met lots of people with tech stocks. Taxi drivers told you what dot-coms they owned. During the housing bubble you met normal, ordinary people who were trading up to expensive homes using adjustable-rate mortgages, buying new condos off plan to flip, and cashing out their fictional “equity” through a refinance mortgage.

But who actually owns gold? I keep hearing about the gold bubble, but every time I ask people if they own any themselves, they say, “no, no, of course not, it’s a bubble.”

Some bubble.

Central banks around the world are printing more dollars, euros, pounds and yen. Gold may simply be a less awful currency than all the others. Banks can’t print any more of it, so its price should probably rise while other currencies fall.

For this year, the question in India seems to be, “Will gold cross Rs.25000, by 2011 Diwali?”

Related articles

- Gold Coins Show Bull Market Unbowed in Commodities Decline (businessweek.com)

- Soros Sells Most of Gold ETP Holdings During First Quarter (businessweek.com)

- A closer look at George Soros’ big quarter of selling gold (financialpost.com)

- Why is George Soros selling gold, but John Paulson not? (theglobeandmail.com)

- China Is Now Top Gold Bug (online.wsj.com)

- Gold Investment Demand in China (lonerangersilver.wordpress.com)

- Chinese set new standard in buying gold (ft.com)

- Gold grand prix – The Chinese challenge (quicktake.wordpress.com)

- Shanghai Planning Gold Exchange-Traded Funds as Demand Jumps (businessweek.com)

- Oil, gold back in demand (news.theage.com.au)

The shadow of oil

Middle East Politics (from Coming apart, coming together By Edward R. Kantowicz; Page 165; courtesy - books.google.com). Click to go to source.

Is Pax Americana like Britain was a hundred years ago? (Cartoon courtesy - mpg50.com.). Click for larger image.

Fat and lazy

Between 1875-1935, Britain was dependent on India for gunpowder, on USA and Iran for oil, on Malaya and India for rubber. British economy had grown fat and uncompetitive – unlike Italian, German and Japanese economies.

Even though Britain won WWII, their economy was a lost cause. Though Germany, Italy and Japan were losers, with their economy in shambles, they could make a brilliant recovery and vastly out-compete Britain.

The story of Middle East oil is similar for USA and West. The Welfare State, built on a diet of cheap oil, easy dollars, is now too expensive for the West to sustain. The above book extract gives an excellent snapshot of the oil industry in the 20th century.

And the shadow of oil on the 21st century.

Related articles

- Onward, American Soldiers! Another million await death. (quicktake.wordpress.com)

- Out with the old? (bbc.co.uk)

- UK economy trailing (thesun.co.uk)

- Skidding Oil Prices: A Blip or a Trend? (green.blogs.nytimes.com)

Boozed British journalism cant see straight

Why compare Japan with Lat-Am and Zimbabwe? Why not with USA, China and Germany which is more like in Japanese class! (Cartoonist - Clay Bennett, from Clay Bennett's Editorial Cartoons; courtesy - cartoonistgroup.com.). Click for larger image.

An Indian problem

Now one of the problems of India, having English as an important language, is the amount of swill, garbage and propaganda that we are subjected to.

In spite of being less than anybody, British media can be pretty biased.

One example was a post by Ian Campbell on Japan’s economic problems. He says,

Japan has … has the worst debt to GDP ratio among major economies … But the interest yield on Japanese government bonds is … not much more than 1 per cent, so the debt is not yet so problematic – and might not seem an obstacle to still more spending. … In just five years, even assuming the economy grows, debt might climb to 230 per cent of GDP … the hideously large debt would finally drive the fiscal deficit far higher and become intolerable.

Japan’s only route then would be drastic fiscal reform or, more probably, huge resort to the printing press, as Latin America did in the old days and Zimbabwe in more recent times. (via Nokia’s billion-dollar man).

British media needs to talk less about other economies - and look at problems in their own backyard. (Cartoon By Brian Adcock, The Scotland - 1/20/2008 12.00.00 AM Cartoon courtesy - politicalcartoons.com; ©Copyright 2008 Brian Adcock - All Rights Reserved.). Click for larger image

Sad Brits …

Campbell, a British journalist, compares Japan with Latin American and African Governments who have printed a lot of money.

But surely he knows that Western Governments – under the leadership of Ben Bernanke printed much more than Africa and Lat-Am could and did! Why is Campbell not talking of British, European and American printing presses?

Is there a racial smell and smear somewhere? Did I hear him say ‘These irresponsible Blacks, Latinas, Browns, Yellows …’

Japan’s problems

Now Japan’s problems are minor – because they have solid, well run, high tech companies, whose products are in demand all over the world.

Off their peaks, these Japanese firms still have mean clout in business world. Japanese interest rates being so low will not change Governmental economics by much. So, why compare Japan with Latin America or Zimbabwe?

Of course, you cannot compare Japan to Spain – where prostitution is a national industry. Or Ireland, or Greece, which have lived on handouts for the last 100 years.

Maybe you should look at British debt my dear sir!

Wishful thinking?

Is it wishful thinking Mr.Campbell? Balanced your judgment is not. Or is it just plain malarkey? Methinks, it is ‘White’ noise!

Ian Campbell, who has “recently returned to the UK, where he is writing a book on rural Mexico.” could utilize his time much better writing about rural Britain, which depends on huge subsidies from a nation groaning under 500% Gross-National-Debt (GND-that is Govt.+Corporate+household).

Now British GND (no hindi puns intended) is a much-more-hideous. Than Japanese at 500%. We both know that British exports are going nowhere!

Cartoon Text - "Austerity? But late squire ... she has been dead these fifty years." 2ndlook says - Is it not time to focus on Britain itself? Japan will do very well, without British attention. (Cartoonist Jeff Danziger; courtesy - cartoonistgroup.com.).

Let us look at British economy

First the biggest sector of British corporate sector is about digging, extracting and selling natural resources.

A historical legacy – with little value-addition. Royal Dutch Shell, BP, North Sea Oil, XStrata, Anglo American, Rio Tinto Group, BHP Billiton, BG Group, National Grid, Scottish and Southern Energy, Centrica. That is 10 of the top 30 British companies. These companies mostly have their assets abroad – and if push comes to shove, you know these companies will go where their bread is buttered.

The second leg on which British industry stands today is cracked leg of banking and insurance – HSBC, HBOS, RBS, Lloyd’s TSB, Barclays, Standard Chartered, Aviva and Prudential. The British part of the business of these 8 financial firms is in mess. The international business is subsidizing the British business. How long do you think this will last?

The third wobbly leg is pharmaceuticals made up of two companies. Glaxo-Smithkline-and Astra Zeneca. Both are in doldrums due to competition from generic Indian companies – and may look good to beery British journalists boozed in a pub. Now these are the three legs of British economy. We know that three legged stools are always prone to topple over.

That was lesson No.1 for you Campbell.

Is this how British journalism lifts its spirits? (By Paresh Nath, The Khaleej Times, UAE - 5/19/2010 12.00.00 AM)

Lallu has a few things to say here

Lesson No.2 is what our colourful former Railway Minister said, “इस हमाम में सब नंगे हैं” (meaning “everyone in this bathhouse is naked”).

No offense to colour black, but then black pots must not call yellow kettles names.

It is plain bad journalism!

Related Articles

- Our Government Is Now So Huge That It’s Choking The Private Sector (businessinsider.com)

- Dollar hits 15-year low vs yen, jumps vs euro (seattletimes.nwsource.com)

- China Buys More Japanese Debt Than Ever Before (businessinsider.com)

Defla-inflation – the Answer to Europe’s Problems

Curse of the ‘Strong-Euro’

Euro-zone would not have gotten itself into such a twist but for chasing the ‘strong’ Euro chimera.

An over-valued Euro made imports cheaper, gave excess inflows, liquidity, and the average Europeans abroad, a false sense of prosperity.

The strong Euro also made way for stagnating, indebted, deficit-prone economies of Europe.

Behind the ‘Strong-Euro’

Of course, Europe needed to make a success of the Euro. If the USA could ride on a dollar-float equal to US GDP, for the last 60 years (1950-2010), could EU be left standing, watching, inactive and hurting (as in envy).

USA let the Euro-Ride continue for the last 7 years (2002-2009) knowing that this can only result in a over-priced, stagnant, option-less Europe. Makes me wonder if Goldman Sachs acted alone in arranging all those off-book loans to Greece?

Hank Paulson … have you been naughty, again?

A nervous Europe

Erosion of Western dominance makes Europe resort to underhand ideas, legalistic sleights of hand that stretch definitions and prolongs the war of attrition.

- With Indian and Chinese manufacturing on the roll a nervous Europe is stuck for answers.

- With Indian pharma and auto sectors challenging the world, Euro-powers are nervous and fidgety.

- With surging Chinese manufacturing, Europe has run out of answers.

- With an indifferent USAon one side and the economic expansion of Asia on the other side makes for one, very nervous Europe.

Luring Kenya, with an Uganda waiting in the wings, by the use of ‘incentives’ to create legal hurdles for pharma-imports is a demonstration of this strategy.

TRIPS recognises IPRs as territorial rights and IP is protected only in the jurisdiction where it is registered. However, Kenya’s recent Anti-Counterfeit Act even recognises IPRs protected in other countries . This would make generic goods imported into or transiting through Kenya illegal if a patent exists anywhere in the world. This has serious repercussions not only for Indian exports but also takes away right of Kenya to independently define patentability criteria based on its development requirements. This is also a loss for Kenya, which in initial stages of its development would be denied the opportunity of drawing innovation and encouraging economic growth within the country.

Many other African countries are being lured into the same trap. There were allegations that EU provided funds for a similar bill in Uganda. Such legislations would deny public access to generic drugs and make them dependent on monopoly of a few patent drug suppliers. Three AIDS victims had to move Kenya’s Constitutional Court against the Anti-Counterfeit Act for a stay on the grounds that it denied them access to generic anti-retroviral drugs and, thus, violated their Right to Life. (via Time to challenge plus-size IPRs-Comments & Analysis-Opinion-The Economic Times).

How will Europe get out of this pit?

How will Europe unwind this complex knot?

The way out for Europe will mean severe belt-tightening. Not an easy thing in easy times, belt-tightening is the bitter pill that Europe may need to swallow.

A mix of defla-inflation with Euro-devaluation will be needed to fix things for some time. Deflation in wages, property and stock prices, inflation in consumer prices combined with Euro devaluation below dollar parity may see Euro zone on the road to growth! Not an easy road!

Is it a wonder that you get to hear a stuck Europe, squealing!

Related articles

- China Rebuffs Hopes It Might Help Bail Out Europe (online.wsj.com)

- Europe Aiming To Ramp Up Crisis Fund As Other Nations Raise Alarm (huffingtonpost.com)

- Pastor to be extradited to Kenya accused of stealing babies (guardian.co.uk)

- Euro Crisis to Hurt Ireland’s Deficit-Cutting Efforts (online.wsj.com)

- The euro will survive (That’s not a typo) (money.cnn.com)

- Mandelson calls for Euro backing (independent.co.uk)

- Crisis, Wages Get Stuck in a Conundrum (online.wsj.com)

- Immi-grunts and Assimilation (behind2ndlook.wordpress.com)

Is China talking down its economy?

Blind spots

In the last few years, the Chinese economy and administration has changed – unannounced and in a very subtle way. There is an interesting openness and candour, which are new elements in the China-mix.

Instead of the usual three themes of real-estate bubble theory, the mega infrastructure projects and the impending dollar-yuan revaluation, this post will look at four other elements. These four elements are usually ignored in most China analysis – which this post will address.

The US recruited Europe, Japan, Asian Tigers - and now China in this manner for the last 60 years.

China opens up

In March 2010, China appointed three economic advisors to ‘help’ the People’s Bank Of China. Drawn from academic backgrounds, the names of the advisors were leaked to the press.

Zhou Qiren, Xia Bin and Li Daokui will replace Fan Gang, formerly the sole academic member of the committee, the People’s Bank of China said in a statement on its Web site today, citing decisions by the State Council, the top cabinet. Zhou and Li have spent much of their careers in teaching and academic study, while Xia has worked as a researcher at government agencies.

Li Daokui has been a forthright and hawkish tone in flagging China’s problems! What gives. The way it seems, these economists are talking down the yuan! An orderly devaluation of the yuan and a negotiated recapitalization awaits Chinese banks.

For the first time ever, China is talking down their economy! (© Copyright 2010 Dave Granlund - All Rights Reserved).

“The housing market problem in China is actually much, much more fundamental, much bigger than the housing market problem in the US and UK before your financial crisis,” he said in an interview. “It is more than [just] a bubble problem.”He was speaking ahead of Monday’s announcement by the State Council that it had approved a plan to reform real estate taxes, the clearest indication yet that the government will for the first time impose an annual tax on some residential housing in order to rein in rising prices. The news sent shares in China down 2.4 percent. (via China Property Risk Is Worse Than in US – CNBC).

Euro-slide Effect

EU is the largest market for Chinese exports.The change in the Euro-yuan equation in the last 6 months has made Chinese exports to the EU more expensive. This will still not take US pressure off yuan revaluation – and anyway there was no much pressure from EU for a Euro-yuan reset!

Graph courtesy - The New York Times

Chinese leaders reached a consensus in early April to break the renminbi’s peg to the dollar. That ended a dispute that had spilled into public view in March when Commerce Ministry officials warned in speeches and interviews in Beijing and Washington about the dangers of any change in the renminbi’s value. The ministry halted those warnings immediately after the consensus was reached, and Chen Deming, the commerce minister, even reversed himself publicly by saying that China’s trade deficit in March was nothing to worry about.

Trade finance out of China

A few quarters ago, China’s trade froze due to lack of trade credit. Chinese banks were unable to get intra-bank limits – and in turn were unable to fund letters of credit for Chinese exporters.

A hiccup in the Chinese realty markets could freeze wheels in China – freezing trade wheels in Asia. As reported earlier in April 2009,

China’s exports rose 7.6% in March from February, after six straight months of contraction. “While exports growth is likely to remain weak in the coming months,” Goldman Sachs economists Yu Song and Helen Qiao commented about China, “we believe the worst sequential slowdown probably is behind us now.”

Some of the revival is due to the greater availability of trade finance, which had dried up as banks clamped down on lending in late 2008, hamstringing global trade.

The Shanghai Composite

In 2010, even as global markets recovered or stabilized, the Chinese Shanghai Composite Index is in bad shape.

In the rankings of the world’s worst-performing stock markets this year, nations drowning in debt feature heavily. Greece is number one, closely followed by Slovakia, Cyprus and Spain. But then, in fifth place, there is China.

Shanghai’s decline – the index is down 16 per cent since January – has caught many investors by surprise, since China is widely seen as a beacon of growth in a world that is still reeling from the financial crisis.

Having fallen to a eight-month low on Thursday, the Shanghai Composite is this year’s worst performing index in Asia.

This may no longer be an issue!

Is the Chinese catastrophe overstated

Mass media usually ends-up following, herd-like, some high-profile ‘opinion makers.’

The China Bubble theory has been pushed by people like Jim Chanos, who cut his teeth by predicting Enron and Tyco. In January this year, he made a widely reported prediction that China is “Dubai times 1000” and is likely to burst any time soon. Chanos’ Biblical imagery and descriptions about China’s, “Treadmill to Hell’ gives the game away. Marc Faber is another boom-and-doom theorist, who has predicted a China bust up! Another economic commentator, Hugh Hendry, in a similar vein, says,

“They suggest a new era reminiscent of Protestant Capitalism. They want us to believe the atheist Chinese are prepared to work harder and defer their gratification for longer.”

These commentators are seemingly painting this economic scenario with theocratic hues! A modern version of the medieval crusades?

Andy Xie, an ex-Morgan Stanley /World Bank expert on China, earned his spurs, with closer to reality, secular reports on bust-and-doom scenarios in China.

The logic of China-busters is very well refuted by those who who are closer to China market and economy – unlike some American Sinologists, who talk to other Sinologists, whose ‘unquestioned’ expertise is based on other Sinologists’ opinion.

The Chinese economic ‘bubble’ may yet burst. But, methinks, the causes, effects and intensity will be, well …

Different!

Some other China posts by 2ndlook

The dangerous case of the Chinese stumper

The dollar and euro need to be devalued by 25%-50% which means yuan must appreciate another 20%-35% from it record high (update on 26th August, 2011)

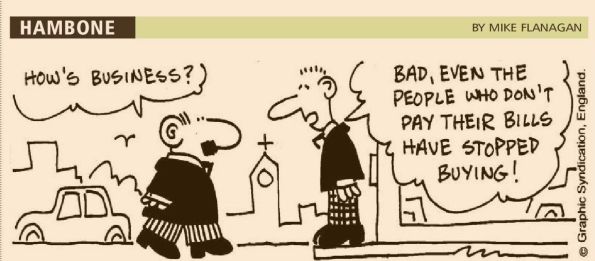

Let us call this the Chinese Stumper! (Hambone by Mike Flanagan; Cartoon courtesy - Business Standard; from issue dated 19th May 2010; Copyright - Graphic Syndication, England).

Siamese’ triplets

The Great Recession is like a case of conjoined triplets.

One is the USA – who has used their Bretton Woods licence to print dollars and flood the world market with excess liquidity. The US has also used their ‘dollar power’ to gain loyalty by favouring their allies, satellites and client states with low exchange rates that boost exports. Europe, Japan, Asian Tigers, (and now) China have all been favored with a ‘beneficial’ exchange rate in the past. At an ‘appropriate’ time, this ‘benefit’ was taken away. The US gained by ‘recruiting’ low-cost labour of these economies.

The US 'out-thunk' the Euro-zone on the Euro-currency strategy!

US imports, were underwritten by an increasing volume of IOUs, denominated in depreciating dollars. By paying for imports with IOU notes, the US could subsidize their high-cost exports, to these ‘semi-captive’ markets.

With dollar IOUs and dollar liquidity, US funded hi-tech R&D, overseas acquisitions (of companies, raw materials, allies), commercialize new technologies and standards (internet, software) space and defense, et al. Last forty-year estimates, show that US obtained funding equal to one full year’s US GDP. At nil cost!

All this due to the US dollar’s reserve currency status!

Can Europe be far behind

Post-Plaza Accord, Europe decided to get into ‘reserve-currency’ game, with the launch of the Euro currency in Jan 2002. As an incentive to TT-Note holders, the ECB ‘allowed’ the Euro to appreciate – vis-à-vis the dollar. This gave windfall gains to countries holding Euro as a reserve currency.

From dollar parity in 2002, the EU appreciated by more than 60%. After the introduction of Euro, in the first six years, Euro-bond holders hit a gusher. Anyone who held Euro bonds from January 2002 upto Decemeber 2007, would have made some 80% return during this six years. A return of 15% per annum. Close to junk bond returns.

After the ECB took the bait, the US played a waiting game. After running with the overvaluation bait, for 8 years, the Euro- fish is now tired. It is not able to break free of the over-valuation hook. The US is now reeling in the fish.

With a ‘strong’ currency, the option for Euro-zone is massive and painful deflation. Wages, pensions, prices, welfare state benefits will need to come down – and drastically. Do they have the steel or the hunger to do this. Used to a gold-plated Welfare State, Euro-zone does not have the moral resolve to go on a cold turkey diet of frugality.

500 years ago, a poor and marginal Europe could take the risk – and inflict genocide, slaughter, war, crime on a hapless world. Today’s geriatric Europe, effete and crumbling, cannot repeat their run of ‘success’, confronted as it is, by a militarily prepared Asia. Modern Europe’s problem is compounded by the lack of availability of victims.

Which brings us to China.

Change in US Govt securities by China - which has ranged between 30%-60% of total reserves. (Image source and courtesy - http://usa.chinadaily.com.cn). Click for larger image.

Doing business with bankrupt customers

China’s currency reserves of some US$2.5 trillion, (Update – US$ 3.2 trillion August 2011) in rapidly depreciating Euros and dollars with manufacturing overcapacity, exports-growth economic model is building into a complicated pressure head. Waiting to blow up. Already under US pressure for a yuan revaluation, add complications like

- Empty building blocks combined with inflated real-estate prices

- Bloated banks loan ledgers with ballooning bad debts

- Low entrepreneurial levels with foreign ownership of Chinese businesses

- Aging population with a dominant public sector

- Increasing foreign exchange reserves of depreciating currencies

and the Chinese Growth story begins to sputter.

As for the Rest of the world

The real challenge for the rest of the world, will be, one, wealth protection. Easily done. Buy gold.

Two, how do we let events unfold – safely. Insulating ourselves from the cycle of calamity, catastrophe, chaos, confrontation, confusion, crises – and then finally a crash.

A cycle that a 86-year young, mentally active, Gujju stock-broker, in Mumbai, shivering with Parkinson’s, explained to me, a few days ago.

Related articles

- ‘Black Death’ of eurozone crisis will hit exports – China (telegraph.co.uk)

- Any euro zone solution requires pain: Stiglitz (theglobeandmail.com)

- German Leaders Reiterate Opposition to Euro Bonds (nytimes.com)

Dollar-Yuan – When the dust settles

Originally published on Wednesday, May 09, 2001 - Cartoon David Horsey; Seattle PI

EU’s trade deficit

The interesting point is how EU manages its trade deficit – without blaming China-Yuan. EU-zone countries like Greece, Ireland, Italy, Portugal, Spain, are on the verge of a sovereign default. Euro-zone is upto its gills in debt. The Euro is being called names. And EU is not snivelling about the yuan and China?

Very un-European!

Usually…

USA, EU Trade Balance with Oil Producers (Graphic source and courtesy - http://www.eurotrib.com). Click for larger image.

Europe is at the forefront seeing dangers, damage, affronts, threats, effects, fall-outs et al. The whole she-bang! But in case of China and Yuan, Europe is not doing much of crying about the ‘undervalued’ Yuan. The Euro revaluation is a recent affair. So, not of much consequence. The Yuan undervaluation has been on the US agenda for a few years now – with varying intensities. Euro-trade balance with China is slightly in China’s favour. All in all, good management by the Euro-zone, it appears.

Which in the current scenario is the one-bright-spot on the Euro-horizon!

Good for them.

The US Treasury has been charged by Congress to assess whether China is a ‘currency manipulator’ … the very concept of currency manipulation is flawed: all governments take actions that directly or indirectly affect the exchange rate. Reckless budget deficits can lead to a weak currency ; so can low interest rates. Until the recent crisis in Greece, the US benefited from a weak dollar-euro exchange rate. Should Europeans have accused the US of ‘manipulating’ the exchange rate to expand exports at its expense?

Although US politicians focus on the bilateral trade deficit with China — which is persistently large — what matters is the multilateral balance. When demands for China to adjust its exchange rate began during George W Bush’s administration, its multilateral trade surplus was small. More recently, however, China has been running a large multilateral surplus as well.

Saudi Arabia also has a bilateral and multilateral surplus: Americans want its oil, and Saudis want fewer US products . Even in absolute value, Saudi Arabia’s multilateral merchandise surplus of $212 billion in 2008 dwarfs China’s $175 billion surplus; as a percentage of GDP, Saudi Arabia’s current-account surplus, at 11.5% of GDP, is more than twice that of China. Saudi Arabia’s surplus would be far higher were it not for US armaments exports.

In a global economy with deficient aggregate demand, current-account surpluses are a problem. But China’s current-account surplus is actually less than the combined figure for Japan and Germany; as a percentage of GDP, it is 5%, compared to Germany’s 5.2%.

Adjustment in the exchange rate is likely to shift to where the US buys its textiles and apparel: from Bangladesh or Sri Lanka, rather than China . Meanwhile, a rise in the exchange rate is likely to contribute to inequality in China, as its poor farmers face increasing competition from the US’ highly subsidised farms. This is the real trade distortion in the global economy, one in which millions of poor people in developing countries are hurt as the US helps some of the world’s richest farmers.

Since China’s multilateral surplus is the economic issue and many countries are concerned about it, the US should seek a multilateral, rules-based solution … Unfortunately, this global crisis was made in the US, and the country must look inward … (via No time for trade war between US and China: Joseph E Stiglitz-International Business-News-The Economic Times).

US trade deficit

Stiglitz, in the post linked above, does a good job in demolishing American propaganda against the Chinese yuan. He shows how while there is case for yuan revaluation, the logic is not what the Americans are giving.

To de-fang American pressure, China recently reported a trade deficit. Much like Europe, Japan, Asian Tigers had to recalibrate their currencies, China too will have to do it. Dollar gyrations are sinking many smaller economies – like the cartoon above from Sri Lanka represents.

The mystery of the forex basket

Increasing the share of Euro in global forex reserves is a long-term EU objective. Is this European quiet related to:-

1. Keeping China happy,

2. Pushing the Euro proposition to the Chinese

3. Increasing the share of Euro in China’s reserves basket.

4. All at the dollar’s expense.

5. After all, who would like to turn away a creditor who is happy with low-to-zero interest with an excess of US$2.5 trillion sloshing around.

6. This US$2.5 trillion can turn Euro-fortunes!

USCAP

.jpg)

Mad Pakistani Tiger eating itself! (Cartoon from Korea Times).

The US has successfully executed US-Client-Acquisition-Programme (USCAP) – a most out-sized ‘conquest’ in history. By using economic levers, it has successfully created client-states across Europe, SE Asia, Japan, China, etc. Some economies have taken the bait, used US incentives and become ‘successful’ client states.

What is most intriguing is Stiglitz’s choice for US largesse – after China. Sri Lanka or Bangladesh, he says. With Pakistan, Sri Lanka and Bangladesh as US clients, India’s may see itself encircled by Anglo-Saxon client states.

A declining West, riding away into the sunset, somehow seems unreal to me.

Related articles

- China Sets Yuan Rate at New High (newser.com)

- Yuan Hits Trading Band Limit Again – WSJ.com (mbcalyn.wordpress.com)

Europe ain’t crying about the Yuan

Euro-zone is not sniffling? What is the secret?

No-one shouts louder than American politicians over the value of China’s currency. But other countries may be ready to speak up too. Five G20 leaders this week called for a more “consistent” approach to exchange rates — with fingers implicitly pointing at China. The yuan is a matter of global concern. But widening the debate might not help the US cause.The euro zone is China’s largest trading partner and the yuan is pegged to the dollar, so euro companies should have more reasons to complain than their American competitors. One dollar, and thus one yuan, is worth quarter less in euros now than in November 2008. (via Group-think needed).

Europe ain’t complaining about the Yuan

Greece, Ireland, Italy, Portugal, Spain, are on the verge of a sovereign default. Eurozone is upto its gills in debt. The Euro is being called names. And they are not snivelling about the Yuan and China.

Very un-European!

The looming Yuan-Dollar currency crisis

No dearth of pretenders - EU, Japan ... and now China!

There are three separate reasons for this … The reasons refer to the broad determinants of economic growth — capital, labour and productivity.

On the first, India is investing at the same rate as China (approximately 40 per cent of GDP), on the second, India’s labour force growth is about 1.8 per cent per year faster than China, and on the third, China has outpaced India by about 2 per cent per annum (for the last five years).

Most of this outpacing has had to do with the deep and deeper currency undervaluation practised by the Chinese authorities which led to two unsatisfactory outcomes: the great financial crisis of 2008, and now the largest and fastest growing polluter of the world.

For how long will the international community stand idly by? Not very, and this is the first big forecast for the ensuing decade: China’s exchange rate will appreciate significantly starting 2010. How significantly? A first year appreciation to about 6 yuan per dollar from the present 6.8 level. (via Surjit S Bhalla: India’s Shining Decade).

Plausible! Probable … Possible?

'Get to heaven by climbing the terraced fields'. Great Leap Forward poster, Artist - Yang Wenxiu, Published - 1958, September, © Stefan R. Landsberger

Surjit Bhalla outlines a plausible scenario – with China needing to adjusting their exchange rate upwards – much like other US client-states had to! Europe had to in the 70s, Japan in the 90s, Asian Tigers in last 10 years. As examined earlier in some detail by 2ndlook. One question is settled. There will be economic mayhem.

However, Bhalla assumes that the Dollar-Yuan revaluation will happen smoothly – without any significant disruption. And that is one, big, huge assumption – which is based on really, really slippery slope.

Bhalla would do well to remember that last time when China had a problem, it resulted in the India China War of 1962. Just after the disastrous Great Leap Forward and before the equally disastrous Cultural Revolution.

The Great Leap Forward began in 1957-58, saw famine and hunger across China. After the Communist takeover of China, land seized from land owners, was given to peasants in 1949. Ten years later, in 1959, the Chinese State took away the same land from the same peasant. Food shortages, starvation followed. Western (questionable) estimates are that 30 million people died during this period. War with India followed in 1962 – a diversion from the domestic Chinese catastrophe.

What will it be this time?

The approaching mayhem

The next few years will be tumultuous for China.

Much like, when Europe was weaned off the low exchange rate crutch in 1967-1974 period. Stagflation, oil shock, the Nixon Chop followed. How Japan had to live with endaka, the Plaza accord, with S&L crisis in the US. Or the Asian Tigers had to reset to a higher exchange rate and higher foreign reserves, that accompanied the 1997 (Asian Crisis) to 2000 (The Tech meltdown).

What will follow the Chinese moment in the sun? What will set off economic mayhem in China?

Crime in China (a simmering threat), terrorism in Xinjiang (remote possibility), real estate bubble (a real scenario), dollar-yuan exchange ratio (significant risk)?

Will the Chinese Government be able to ride this storm? Without a war with India? Which side of the fence will China fall? Answers to these questions will be worth waiting for! And prepared with!

Signs of coming troubles?

Great Leap Forward © Stefan R. Landsberger; Source - Zhongguo meishuguan (ed.), 中国美术年鉴 1949-1989 (Guilin: Guangxi meishu chubanshe, 1993). Designer: Zhang Xin'guo (张辛国); Liu Duan (刘端); 1958, October; Put organizations on a military footing, put actions on a war footing, put life on a collective footing; Zuzhi junshihua, xingdong zhandouhua, shenghuo jitihua (组织军事化,行动战斗化,生活集体化); Publisher: Hebei renmin meishu chubanshe (河北人民美术出版社).

When the Soviet Union imploded, one of the unexpected fall out was the Russian mafia. Recent troubles in China, with the underworld creates a spectre of yet another mafia creating global disturbances. One more element in global trouble spots. To understand this better, turn to Chinese cinema.

Most films that have any Chinese element in it, (actors, directors, characters, locations) end up having the Chinese underworld as an important part of the storyline. Is it that the Chinese are morbidly fascinated by criminals and the underworld – much like Europe was with English pirates and murdering Spanish Conquistadors.

Ranging from Jet Li in Kiss of the Dragon, (Jet Li takes on the French mafia) or Chow Yun-Fat in The Corrupter (exposing police-underworld nexus and corruption in the USA), or Jackie Chan in Rush Hour series or the Chinese Ric Young in The Transporter, Jet Li in Lethal Weapon 4.

All have two elements in common.One is the pervasive Chinese underworld. Across Europe, in the USA. In drugs, fake currency, in smuggling boat people, the Chinese are there – everywhere. Many of these movies have Chinese stars, directed by Chinese directors or even partly funded by Chinese studios .

The second is the absence of the Buddhist monk.

India – the loose cannon!

What kind of ending will we see ...?

Now, India is one box which defies description. By any global and historical standards, the country should not even exist – much less prosper, or be a significant global player. Too many languages, too much poverty, too much freedom, too many political parties, too many languages, too many religions, too many racial types are the common factors going against India (so goes the Desert Bloc narrative).

In such a situation, even in India, for the Westernized types or the remnants of the Desert Bloc admirers, India remains a failure waiting to happen.

Unfortunately, for these doubting Cassandra’s, India has proven them wrong for more than 5000 years now!

Exciting new series. From 1 Mar, 2010.

Exciting new series. From 1 Mar, 2010.