Archive

EU to use drones for policing farmers

European skies are to become home to new drones. The remote–controlled unmanned aircraft are set to police Europe’s farmlands for possible cheating and law violation. The decision has sparked grave privacy concerns.

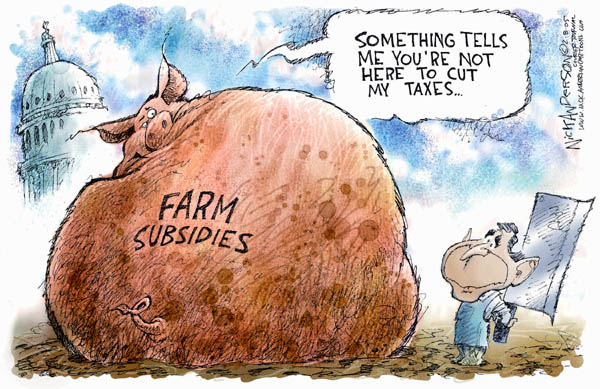

Each year the European Union spends almost half of its budget on its Common Agricultural Policy. Europe’s farms and agricultural lands cost taxpayers billions of euros in subsidies.

Cases of fraudulent subsidy claims are many. But as the cheating gets more inventive, the agricultural inspectors get more technologically advanced.

EU regulators have in the past used satellites to keep an eye on those claiming subsidies. These provided aerial images of farmlands, which were searched for signs of possible subsidy cheating or breaches of environmental rules.

But satellite images proved a failure in unfavorable weather conditions and mountainous terrain. One case was even dropped in court due to insufficient satellite evidence.

In their quest for more reliable instruments, EU inspectors chose unmanned aerial vehicles.

Used mostly for combat missions and surveillance, the drones will now serve agricultural policing aims.

Reports suggest that France and Italy are already trying them out for this purpose. (via EU farm-policing drone plan sparks anger — RT).

Champions of ‘Free Trade’

This brings two issues to the fore.

Why do Western farmers need close to US$100 billion (EU subsidy-US$75 billion & US subsidy-US$25 billion) in subsidy to compete with African and Indian farmers? Remember shortages in Europe after WWII? Is that the future of the West?

Can there be ‘free trade’ with US$100 billion in subsidy?

Leaders of the ‘Free World’

Between Europe and USA, there are more CCTVs, data recording (telephone, internet, conversations, et al) than what any secret or any other type of police ever had. The West has the largest prison population in the history of mankind.

More than 2 million in US alone – and another half a million in EU. More than Russia (0.85 million) and China (15.5) combined.

The one big difference between China and Russia on one hand and the West on the other is paperwork. The West produces enormous paperwork, procedure, laws, lawyers, to convince so many people to keep so many people in prison. Unlike China and Russia – who are not yet so skilled at this kind of show.

Now the ‘Free’ World will spy on its own farmers.

Some freedom, this.

Related articles

- DRONES OVER EUROPE? Proposal To Watch EU Subsidized Farms (businessinsider.com)

- Satellites spy on Europe’s farms (bbc.co.uk)

- Spy Drones Already Circle Crops in Europe (rogueoperator.wordpress.com)

- Drones to gain greater freedom in US airspace (and become a safety nightmare) (theaviationist.com)

- EU farm-policing drone plan sparks anger (rt.com)

- EU rules ‘encouraging farmers to plough up grasslands’ (guardian.co.uk)

- RSPB and National Trust may lose millions due to EU reforms (guardian.co.uk)

Of Mice and Men – 2015 Gold Outlook

USA, EU trade relationships with oil producers. The European hands-on, micro-management issue of trade balance seems to be delivering? Some may question, what it is delivering, though.

Of mice and men

While the US dollar is weakening, by design, Greece, Ireland, Portugal and Spain are being bankrupted by a deliberately overvalued Euro.

In such a scenario, China believes that it has a winning hand. Even though, the Chinese exports juggernaut has been slowed by a yuan, trading at 17 year-highs. March 2011 reports indicate

an unexpected $7.3 billion trade deficit, the biggest in seven years. The nation’s (China’s) exports rose at the slowest pace since November 2009.

The US is betting that a weak dollar will reignite economic growth – much like what happened after the Japanese Yen strengthened due to Plaza Accord (1985).

For Europe, the grand prix is to replace the dollar as the currency of international trade – especially oil trade. Euro as a international trade-currency-of-choice, will give the Euro region access to more than 1 trillion euros in zero-cost floating balances.

China is expecting the yuan to play a similar role. Such are plans made by mice and men.

Monsieur Murphy says

What can go wrong with these plans? Plenty.

The eternal enemy of currency manipulation – gold. As a million bureaucrats work on the mechanics of their plans,

Increasingly, everyone is a victim - except the powerful 0.5% elite that rules the world. Break their power. Buy gold. (Cartoonist - Ted Rall; courtesy - http://charlesgoyette.com). Click for larger image.

Sales of gold coins are on track for the best month in a year amid the worst commodities rout since 2008, a sign that bullion’s longest bull market in nine decades has further to run, if history is a guide.

The U.S. Mint sold 85,000 ounces of American Eagle coins since May 1 as the Standard & Poor’s GSCI Index of 24 raw materials fell 9.9 percent. The last time sales reached that level, bullion rose 21 percent in the next year. Gold will advance 17 percent to a record $1,750 an ounce by Dec. 31 and keep gaining in 2012, the median estimate in a Bloomberg survey of 31 analysts, traders and investors shows.

UBS AG, Switzerland’s biggest bank, had its second-best day this year for physical sales on May 9, according to a report the following day. The bank’s sales to India, the world’s top bullion consumer, are more than 10 percent higher than in 2010. (via Gold Coins Show Bull Market Unbowed in Commodities Decline – Bloomberg).

You take free advice …?

While George Soros talks of gold being the ultimate bubble, his companies are quietly buying gold.

Back in late January, as the world’s important people rubbed elbows in Davos, billionaire investor George Soros had some rather definitive thoughts to offer on gold, which he called “the ultimate asset bubble,” according to reports.

However, he neglected to mention that his hedge fund had been buying.

Another report points out that the liquidation (by people like Soros) of investments in public investment vehicles may be replaced by private investments.

In this game of musical chairs, when the music stops, everyone who does not own gold is out. (Cartoon by David Horsey; Courtesy - http://politicalhumor.about.com). Click for larger image.

The new filings from funds “may show that big names exited ETPs and this news may cause prices to slip in the very short term,” said Bayram Dincer, an analyst at LGT Capital Management in Pfaeffikon, Switzerland. Some funds switched to holding gold directly so they wouldn’t have to announce it publicly, he said.

Is gold a bubble?

A rather disbelieving journalist writes of the situation in the West

Gold is in a bubble. Anyone will tell you that. They’ve been saying it since gold was about, oh, $500 an ounce. But it’s a funny kind of a bubble. It’s the only one I’ve encountered where so few people seem to own the asset in question.

During the dot-com bubble, you met lots of people with tech stocks. Taxi drivers told you what dot-coms they owned. During the housing bubble you met normal, ordinary people who were trading up to expensive homes using adjustable-rate mortgages, buying new condos off plan to flip, and cashing out their fictional “equity” through a refinance mortgage.

But who actually owns gold? I keep hearing about the gold bubble, but every time I ask people if they own any themselves, they say, “no, no, of course not, it’s a bubble.”

Some bubble.

Central banks around the world are printing more dollars, euros, pounds and yen. Gold may simply be a less awful currency than all the others. Banks can’t print any more of it, so its price should probably rise while other currencies fall.

For this year, the question in India seems to be, “Will gold cross Rs.25000, by 2011 Diwali?”

Related articles

- Gold Coins Show Bull Market Unbowed in Commodities Decline (businessweek.com)

- Soros Sells Most of Gold ETP Holdings During First Quarter (businessweek.com)

- A closer look at George Soros’ big quarter of selling gold (financialpost.com)

- Why is George Soros selling gold, but John Paulson not? (theglobeandmail.com)

- China Is Now Top Gold Bug (online.wsj.com)

- Gold Investment Demand in China (lonerangersilver.wordpress.com)

- Chinese set new standard in buying gold (ft.com)

- Gold grand prix – The Chinese challenge (quicktake.wordpress.com)

- Shanghai Planning Gold Exchange-Traded Funds as Demand Jumps (businessweek.com)

- Oil, gold back in demand (news.theage.com.au)

Europe’s Probable Fall

Europe's Titanic ego problem - May 10, 2010, at 06.27 PM (Cartoonist-Cam Cardow, copyright 2010 Cagle Cartoons; courtesy - caglecartoons.com.). Click for larger image.

The success of Europe is considerable, but must not be exaggerated. There are still problems, including poverty to cite only one example, several million children in the UK suffer from malnutrition. While Europe has succeeded in attracting new members, it has not been successful in integrating its new immigrant populations. The European project is being tested by the lack of success of the Lisbon treaty.

The problem, however, is that while the peace will probably last another major European war is a very unlikely scenario the prosperity may not.

The choice is basically as follows. By accepting reform and the need for some sacrifices, the European fall will occur, but it will be reasonably gentle and gradual. By refusing to reform and rejecting sacrifice, Europe’s fall will be precipitate. At the moment, unfortunately, the more likely scenario is the second one. (read more via Europe’s Probable Fall – The Times of India).

A culture of entitlement has robbed European society of its vitality. The writer feels that Europe can choose how it will decline. Gradually and gently. Otherwise, precipitate – sudden, visible, maybe violent. I am being gentle by call it decline. Lehman says it is fall. No less.

Probably, many in India and the Indians abroad, the RNIs and the NRIs, brought up on the milk of Western superiority will mourn the passing away of their ‘dream’. I am sure they will quickly find some other ‘superior’ culture for loyalties.

The dream is dead. Long live the dream.

Related Articles

- Euro crisis: will Ireland sink the rest of Europe? (telegraph.co.uk)

- €1,650bn of pain for Europe’s peripherals, SocGen says (ftalphaville.ft.com)

- Will Europe’s Financial Crisis Finish the Euro and the EU? (seekingalpha.com)

- Cheer up! At least we’re not Europe! [Fritzworth] (minx.cc)

The Arctic’s strategic value for Russia

In this Aug. 24, 2009 picture provided by the U.S. Coast Guard, the U.S. Coast Guard Cutter Healy breaks ice ahead of the Canadian Coast Guard Ship Louis S. St-Laurent in the Arctic Ocean. The two ships are taking part in a multi-year, multi-agency Arctic survey that will help define the Arctic continental shelf. Photo: AP; Courtesy-thehindu.com.

NATO, for the first time, officially claimed a role in the Arctic, when Secretary-General Jaap de Hoop Scheffer told member-states to sort out their differences within the alliance so that it could move on to set up “military activity in the region.”

“Clearly, the High North is a region that is of strategic interest to the Alliance,” he said at a NATO seminar in Reykjavik, Iceland, in January 2009.

Can the West see beyond oil in the next 50 years. Not unless, they are led by their nose. (Cartoonist-Matt Wuerker; Date-25-6-2008; Courtesy-cartonistgroup.com; Copyright-Matt Wuerker). Click for larger image.

Since then, NATO has held several major war games focussing on the Arctic region. In March this year, 14,000 NATO troops took part in the “Cold Response 2010” military exercise held in Norway under a patently provocative legend: the alliance came to the defence of a fictitious small democratic state, Midland, whose oilfield is claimed by a big undemocratic state, Nordland. In August, Canada hosted its largest yet drill in the Arctic, Operation Nanook 2010, in which the U.S. and Denmark took part for the first time.

Russia registered its firm opposition to the NATO foray, with President Dmitry Medvedev saying the region would be best without NATO. “Russia is keeping a close eye on this activity,” he said in September. “The Arctic can manage fine without NATO.” The western media portrayed the NATO build-up in the region as a reaction to Russia’s “aggressive” assertiveness, citing the resumption of Arctic Ocean patrols by Russian warships and long-range bombers and the planting of a Russian flag in the North Pole seabed three years ago.

It is conveniently forgotten that the U.S. Navy and Air Force have not stopped Arctic patrolling for a single day since the end of the Cold War. Russia, on the other hand, drastically scaled back its presence in the region after the break-up of the Soviet Union. It cut most of its Northern Fleet warships, dismantled air defences along its Arctic coast and saw its other military infrastructure in the region fall into decay.

(Cartoonist-Chip Bok; Date-23-6-2008; Courtesy-cartonistgroup.com; Image subject to copyright). Click for larger image.

The Arctic has enormous strategic value for Russia. Its nuclear submarine fleet is based in the Kola Peninsula. Russia’s land territory beyond the Arctic Circle is almost the size of India — 3.1 million sq km. It accounts for 80 per cent of the country’s natural gas production, 60 per cent of oil, and the bulk of rare and precious metals. By 2030, Russia’s Arctic shelf, which measures 4 million sq km, is expected to yield 30 million tonnes of oil and 130 billion cubic metres of gas. If Russia’s claim for a 350-mile EEZ is granted, it will add another 1.2 million sq km to its possessions.

A strategy paper Mr. Medvedev signed in 2008 said the polar region would become Russia’s “main strategic resource base” by 2020. Russia has devised a multivector strategy to achieve this goal. First, it works to restore its military capability in the region to ward off potential threats. Russia is building a new class of nuclear submarines, Borei (Northern Wind) that will be armed with a new long-range missile, Bulava. Navy Chief Admiral Vladimir Vysotsky said recently he had also drawn up a plan to deploy warships in Russia’s Arctic ports to protect polar sea routes. (via The Arctic’s strategic value for Russia By Vladimir Radyuhin.)

Thin ice …

Some sixteen months ago, 2ndlook speculated that West’s redemption may come from oil – from the Arctic. With receding Arctic ice-caps, the West may find itself sitting on large oil reserves. Production from these discoveries may take 10-25 years – climate permitting.

West on the drip - needs Arctic oil. (Cartoon title- Arctic Oil; Cartoon By - Monte Wolverton, Copyright-Monte Wolverton; Date - 3/20/2005 12.00.00 AM). Click for larger image.

Climate change, I don’t believe in. How long will these weather patterns persist? The West is skating on thin ice – but then what can they do. Slavery is not an option – not for another 50-100 years at least. Dig mother earth, is the second and only option they have believed in.

For the last 3000 years at least.

Related Articles

- Russia and Norway resolve Arctic border dispute (guardian.co.uk)

- Russia, Canada in rivalry over Arctic resources (seattletimes.nwsource.com)

- Russia, Canada make competing claims to Arctic resources (foxnews.com)

- Russia to boost Arctic research (blogs.nature.com)

- Senior Nato commander warns of potential conflict over Arctic resources (guardian.co.uk)

- Russia, Canada in rivalry over Arctic resources (ctv.ca)

- Russia, Canada and Denmark to file Arctic claims to UN (theglobeandmail.com)

- Canada, Russia expect to win Arctic claims at UN (cbc.ca)

- Coast Guard: Russia makes inroads in Arctic, and we should, too (chron.com)

- Military forces ‘will keep the Arctic safe’ (telegraph.co.uk)

Defla-inflation – the Answer to Europe’s Problems

Curse of the ‘Strong-Euro’

Euro-zone would not have gotten itself into such a twist but for chasing the ‘strong’ Euro chimera.

An over-valued Euro made imports cheaper, gave excess inflows, liquidity, and the average Europeans abroad, a false sense of prosperity.

The strong Euro also made way for stagnating, indebted, deficit-prone economies of Europe.

Behind the ‘Strong-Euro’

Of course, Europe needed to make a success of the Euro. If the USA could ride on a dollar-float equal to US GDP, for the last 60 years (1950-2010), could EU be left standing, watching, inactive and hurting (as in envy).

USA let the Euro-Ride continue for the last 7 years (2002-2009) knowing that this can only result in a over-priced, stagnant, option-less Europe. Makes me wonder if Goldman Sachs acted alone in arranging all those off-book loans to Greece?

Hank Paulson … have you been naughty, again?

A nervous Europe

Erosion of Western dominance makes Europe resort to underhand ideas, legalistic sleights of hand that stretch definitions and prolongs the war of attrition.

- With Indian and Chinese manufacturing on the roll a nervous Europe is stuck for answers.

- With Indian pharma and auto sectors challenging the world, Euro-powers are nervous and fidgety.

- With surging Chinese manufacturing, Europe has run out of answers.

- With an indifferent USAon one side and the economic expansion of Asia on the other side makes for one, very nervous Europe.

Luring Kenya, with an Uganda waiting in the wings, by the use of ‘incentives’ to create legal hurdles for pharma-imports is a demonstration of this strategy.

TRIPS recognises IPRs as territorial rights and IP is protected only in the jurisdiction where it is registered. However, Kenya’s recent Anti-Counterfeit Act even recognises IPRs protected in other countries . This would make generic goods imported into or transiting through Kenya illegal if a patent exists anywhere in the world. This has serious repercussions not only for Indian exports but also takes away right of Kenya to independently define patentability criteria based on its development requirements. This is also a loss for Kenya, which in initial stages of its development would be denied the opportunity of drawing innovation and encouraging economic growth within the country.

Many other African countries are being lured into the same trap. There were allegations that EU provided funds for a similar bill in Uganda. Such legislations would deny public access to generic drugs and make them dependent on monopoly of a few patent drug suppliers. Three AIDS victims had to move Kenya’s Constitutional Court against the Anti-Counterfeit Act for a stay on the grounds that it denied them access to generic anti-retroviral drugs and, thus, violated their Right to Life. (via Time to challenge plus-size IPRs-Comments & Analysis-Opinion-The Economic Times).

How will Europe get out of this pit?

How will Europe unwind this complex knot?

The way out for Europe will mean severe belt-tightening. Not an easy thing in easy times, belt-tightening is the bitter pill that Europe may need to swallow.

A mix of defla-inflation with Euro-devaluation will be needed to fix things for some time. Deflation in wages, property and stock prices, inflation in consumer prices combined with Euro devaluation below dollar parity may see Euro zone on the road to growth! Not an easy road!

Is it a wonder that you get to hear a stuck Europe, squealing!

Related articles

- China Rebuffs Hopes It Might Help Bail Out Europe (online.wsj.com)

- Europe Aiming To Ramp Up Crisis Fund As Other Nations Raise Alarm (huffingtonpost.com)

- Pastor to be extradited to Kenya accused of stealing babies (guardian.co.uk)

- Euro Crisis to Hurt Ireland’s Deficit-Cutting Efforts (online.wsj.com)

- The euro will survive (That’s not a typo) (money.cnn.com)

- Mandelson calls for Euro backing (independent.co.uk)

- Crisis, Wages Get Stuck in a Conundrum (online.wsj.com)

- Immi-grunts and Assimilation (behind2ndlook.wordpress.com)

Is China talking down its economy?

Blind spots

In the last few years, the Chinese economy and administration has changed – unannounced and in a very subtle way. There is an interesting openness and candour, which are new elements in the China-mix.

Instead of the usual three themes of real-estate bubble theory, the mega infrastructure projects and the impending dollar-yuan revaluation, this post will look at four other elements. These four elements are usually ignored in most China analysis – which this post will address.

The US recruited Europe, Japan, Asian Tigers - and now China in this manner for the last 60 years.

China opens up

In March 2010, China appointed three economic advisors to ‘help’ the People’s Bank Of China. Drawn from academic backgrounds, the names of the advisors were leaked to the press.

Zhou Qiren, Xia Bin and Li Daokui will replace Fan Gang, formerly the sole academic member of the committee, the People’s Bank of China said in a statement on its Web site today, citing decisions by the State Council, the top cabinet. Zhou and Li have spent much of their careers in teaching and academic study, while Xia has worked as a researcher at government agencies.

Li Daokui has been a forthright and hawkish tone in flagging China’s problems! What gives. The way it seems, these economists are talking down the yuan! An orderly devaluation of the yuan and a negotiated recapitalization awaits Chinese banks.

For the first time ever, China is talking down their economy! (© Copyright 2010 Dave Granlund - All Rights Reserved).

“The housing market problem in China is actually much, much more fundamental, much bigger than the housing market problem in the US and UK before your financial crisis,” he said in an interview. “It is more than [just] a bubble problem.”He was speaking ahead of Monday’s announcement by the State Council that it had approved a plan to reform real estate taxes, the clearest indication yet that the government will for the first time impose an annual tax on some residential housing in order to rein in rising prices. The news sent shares in China down 2.4 percent. (via China Property Risk Is Worse Than in US – CNBC).

Euro-slide Effect

EU is the largest market for Chinese exports.The change in the Euro-yuan equation in the last 6 months has made Chinese exports to the EU more expensive. This will still not take US pressure off yuan revaluation – and anyway there was no much pressure from EU for a Euro-yuan reset!

Graph courtesy - The New York Times

Chinese leaders reached a consensus in early April to break the renminbi’s peg to the dollar. That ended a dispute that had spilled into public view in March when Commerce Ministry officials warned in speeches and interviews in Beijing and Washington about the dangers of any change in the renminbi’s value. The ministry halted those warnings immediately after the consensus was reached, and Chen Deming, the commerce minister, even reversed himself publicly by saying that China’s trade deficit in March was nothing to worry about.

Trade finance out of China

A few quarters ago, China’s trade froze due to lack of trade credit. Chinese banks were unable to get intra-bank limits – and in turn were unable to fund letters of credit for Chinese exporters.

A hiccup in the Chinese realty markets could freeze wheels in China – freezing trade wheels in Asia. As reported earlier in April 2009,

China’s exports rose 7.6% in March from February, after six straight months of contraction. “While exports growth is likely to remain weak in the coming months,” Goldman Sachs economists Yu Song and Helen Qiao commented about China, “we believe the worst sequential slowdown probably is behind us now.”

Some of the revival is due to the greater availability of trade finance, which had dried up as banks clamped down on lending in late 2008, hamstringing global trade.

The Shanghai Composite

In 2010, even as global markets recovered or stabilized, the Chinese Shanghai Composite Index is in bad shape.

In the rankings of the world’s worst-performing stock markets this year, nations drowning in debt feature heavily. Greece is number one, closely followed by Slovakia, Cyprus and Spain. But then, in fifth place, there is China.

Shanghai’s decline – the index is down 16 per cent since January – has caught many investors by surprise, since China is widely seen as a beacon of growth in a world that is still reeling from the financial crisis.

Having fallen to a eight-month low on Thursday, the Shanghai Composite is this year’s worst performing index in Asia.

This may no longer be an issue!

Is the Chinese catastrophe overstated

Mass media usually ends-up following, herd-like, some high-profile ‘opinion makers.’

The China Bubble theory has been pushed by people like Jim Chanos, who cut his teeth by predicting Enron and Tyco. In January this year, he made a widely reported prediction that China is “Dubai times 1000” and is likely to burst any time soon. Chanos’ Biblical imagery and descriptions about China’s, “Treadmill to Hell’ gives the game away. Marc Faber is another boom-and-doom theorist, who has predicted a China bust up! Another economic commentator, Hugh Hendry, in a similar vein, says,

“They suggest a new era reminiscent of Protestant Capitalism. They want us to believe the atheist Chinese are prepared to work harder and defer their gratification for longer.”

These commentators are seemingly painting this economic scenario with theocratic hues! A modern version of the medieval crusades?

Andy Xie, an ex-Morgan Stanley /World Bank expert on China, earned his spurs, with closer to reality, secular reports on bust-and-doom scenarios in China.

The logic of China-busters is very well refuted by those who who are closer to China market and economy – unlike some American Sinologists, who talk to other Sinologists, whose ‘unquestioned’ expertise is based on other Sinologists’ opinion.

The Chinese economic ‘bubble’ may yet burst. But, methinks, the causes, effects and intensity will be, well …

Different!

Some other China posts by 2ndlook

The dangerous case of the Chinese stumper

The dollar and euro need to be devalued by 25%-50% which means yuan must appreciate another 20%-35% from it record high (update on 26th August, 2011)

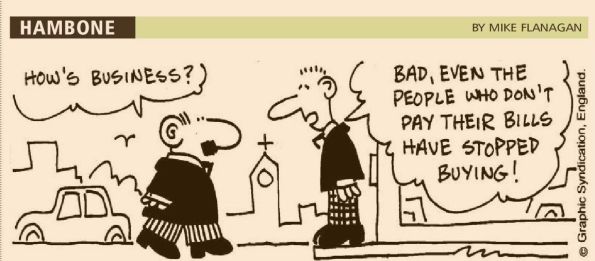

Let us call this the Chinese Stumper! (Hambone by Mike Flanagan; Cartoon courtesy - Business Standard; from issue dated 19th May 2010; Copyright - Graphic Syndication, England).

Siamese’ triplets

The Great Recession is like a case of conjoined triplets.

One is the USA – who has used their Bretton Woods licence to print dollars and flood the world market with excess liquidity. The US has also used their ‘dollar power’ to gain loyalty by favouring their allies, satellites and client states with low exchange rates that boost exports. Europe, Japan, Asian Tigers, (and now) China have all been favored with a ‘beneficial’ exchange rate in the past. At an ‘appropriate’ time, this ‘benefit’ was taken away. The US gained by ‘recruiting’ low-cost labour of these economies.

The US 'out-thunk' the Euro-zone on the Euro-currency strategy!

US imports, were underwritten by an increasing volume of IOUs, denominated in depreciating dollars. By paying for imports with IOU notes, the US could subsidize their high-cost exports, to these ‘semi-captive’ markets.

With dollar IOUs and dollar liquidity, US funded hi-tech R&D, overseas acquisitions (of companies, raw materials, allies), commercialize new technologies and standards (internet, software) space and defense, et al. Last forty-year estimates, show that US obtained funding equal to one full year’s US GDP. At nil cost!

All this due to the US dollar’s reserve currency status!

Can Europe be far behind

Post-Plaza Accord, Europe decided to get into ‘reserve-currency’ game, with the launch of the Euro currency in Jan 2002. As an incentive to TT-Note holders, the ECB ‘allowed’ the Euro to appreciate – vis-à-vis the dollar. This gave windfall gains to countries holding Euro as a reserve currency.

From dollar parity in 2002, the EU appreciated by more than 60%. After the introduction of Euro, in the first six years, Euro-bond holders hit a gusher. Anyone who held Euro bonds from January 2002 upto Decemeber 2007, would have made some 80% return during this six years. A return of 15% per annum. Close to junk bond returns.

After the ECB took the bait, the US played a waiting game. After running with the overvaluation bait, for 8 years, the Euro- fish is now tired. It is not able to break free of the over-valuation hook. The US is now reeling in the fish.

With a ‘strong’ currency, the option for Euro-zone is massive and painful deflation. Wages, pensions, prices, welfare state benefits will need to come down – and drastically. Do they have the steel or the hunger to do this. Used to a gold-plated Welfare State, Euro-zone does not have the moral resolve to go on a cold turkey diet of frugality.

500 years ago, a poor and marginal Europe could take the risk – and inflict genocide, slaughter, war, crime on a hapless world. Today’s geriatric Europe, effete and crumbling, cannot repeat their run of ‘success’, confronted as it is, by a militarily prepared Asia. Modern Europe’s problem is compounded by the lack of availability of victims.

Which brings us to China.

Change in US Govt securities by China - which has ranged between 30%-60% of total reserves. (Image source and courtesy - http://usa.chinadaily.com.cn). Click for larger image.

Doing business with bankrupt customers

China’s currency reserves of some US$2.5 trillion, (Update – US$ 3.2 trillion August 2011) in rapidly depreciating Euros and dollars with manufacturing overcapacity, exports-growth economic model is building into a complicated pressure head. Waiting to blow up. Already under US pressure for a yuan revaluation, add complications like

- Empty building blocks combined with inflated real-estate prices

- Bloated banks loan ledgers with ballooning bad debts

- Low entrepreneurial levels with foreign ownership of Chinese businesses

- Aging population with a dominant public sector

- Increasing foreign exchange reserves of depreciating currencies

and the Chinese Growth story begins to sputter.

As for the Rest of the world

The real challenge for the rest of the world, will be, one, wealth protection. Easily done. Buy gold.

Two, how do we let events unfold – safely. Insulating ourselves from the cycle of calamity, catastrophe, chaos, confrontation, confusion, crises – and then finally a crash.

A cycle that a 86-year young, mentally active, Gujju stock-broker, in Mumbai, shivering with Parkinson’s, explained to me, a few days ago.

Related articles

- ‘Black Death’ of eurozone crisis will hit exports – China (telegraph.co.uk)

- Any euro zone solution requires pain: Stiglitz (theglobeandmail.com)

- German Leaders Reiterate Opposition to Euro Bonds (nytimes.com)

Fears of German exit from EMU

EU's having a difficult time!

weak states cannot easily leave EMU because they would pay a stiff penalty in higher rates, would be stuck with euro debt contracts, and might need controls to stem capital flight. It is a different calculus for Germany, which would see lower rates and might view EMU exit as the only way to ensure monetary stability.”Obviously, we have not reached the end game yet. However, with the latest developments, such a break-up scenario has clearly become more likely. The risk is far from negligible and the consequences for financial markets would be very severe. Investors ignore the break-up risk at their peril,” he said. (via Morgan Stanley fears German exit from EMU – Telegraph).

How many Euro-currencies …

A super-dense, power-currency, union between France, Germany, Italy and UK may have a chance of survival. At least, Joachim Starbatty, a professor emeritus of economics at the University of Tübingen, seriously proposes that Germany withdraw from the EMU. In which case what happens to the Euro? Will it become a 2nd-class currency of the Euro-zone?Will Europe splinter into another 20 currencies?

Idle minds?

Turning the clock back, to recreate a German Deutschmarks, surely the Germans realize, is the last resort. A en flambé Europe may justify such a last step. Europe is at least a few decades away from such a situation. Unless the gentle decline of Europe gathers significant pace, such thinking will be defeatist. Europe has invested too much and gone too far down the road to turn back. In a stressed financial sector, mandates are difficult and far in between.

One way to draw attention is to give out such reports.

Exciting new series. From 1 Mar, 2010.

Exciting new series. From 1 Mar, 2010.